How To Make Money With Taxes For Having Your Own Business?

The economic climate is still reeling from the COVID-19 pandemic. Some 12% of small-scale business concern owners say financial stability is the most important challenge for them, beaten only by loss of business and alluring new customers.

Information technology'due south no surprise that taxes—a pecker that arrives at the end of each fiscal year—is the second-most of import problem for small businesses in the US.

Managing your taxes for your retail shop doesn't have to be a headache. This guide shares how taxes bear on your business, with 15 bonus tips on how to make tax season more stress-free.

Annotation: This guide is provided for advisory purposes only and is not intended to substitute for obtaining bookkeeping, tax, or financial advice from a professional accountant.

How taxes touch your business

Every small-business owner in the U.s.a. needs to pay taxes. While the exact amount you'll pay varies by state and business structure, taxes are one of the biggest costs associated with running a retail shop. The average small business organisation pays a 19.eight% tax rate on their income.

Along with being one of the largest business concern expenses, taxes are one of the most important bills. Pocket-size concern owners that file their taxes late, inaccurately, or abandon them altogether confront fines—or in extreme cases, criminal prosecution.

The skillful news? Small-concern taxes aren't every bit complex as yous might think. A certified public auditor (CPA) will help you lot legally reduce your tax liability and then you're not left with a huge beak to pay at year end.

fifteen modest business organisation tax tips

The last thing y'all want to experience is frazzled when revenue enhancement fourth dimension rolls around. Here are fifteen taxation saving tips to help prepare and manage your small business' accounts throughout the year.

- Know your financial jargon

- Separate business and personal finances

- Keep accurate records

- Utilise accounting software

- Pay estimated quarterly taxes

- Set aside cash for payroll taxes

- Track inventory accurately

- Know what'southward revenue enhancement deductible

- Contribute to your retirement account

- Make a charitable donation

- Use section 179

- Use bonus depreciation

- Apply for the qualified business income reduction

- Ready for revenue enhancement season in advance

- Hire an accountant

1. Know your fiscal jargon

Many taxpayers think they need a new dictionary to sympathise their revenue enhancement return. The world of accounting comes with its own specialized terminology. Spend some time learning jargon that will aid you understand your business' fiscal position.

Here'due south a quick explainer for some mutual phrases you might see on your balance sheet:

- Acquirement : The amount of money earned through product sales.

- Cost of appurtenances sold (COGS): The cost of producing products sold by your business.

- Gross profit: The money left over after subtracting the COGS from full revenue.

- Internet sales: Total profit made after deducting all expenses from total acquirement.

Lily Volition, founder and CEO at NiaWigs, puts this into practice: "Small-business owners frequently overlook the deviation betwixt their net and gross income.

"For example, if your product costs $100 to create and sells for $150, your gross profit is $50. However, later deducting your expenses, your cyberspace income might be equally little as $x. So information technology's critical to empathize your gross and internet profits to increase profitability and aggrandize your company."

💡 PRO TIP: To see your net sales, price of goods sold, and gross profit, view the Finances summary folio in Shopify admin.

ii. Separate business organization and personal finances

The first thing y'all should do when starting a small business is create a new bank account.

One of the simplest ways to arrive tax trouble is having personal expenses recorded as business expenses. The more than on top of your business and personal taxation records you lot are, the less likely that the IRS volition find anything wrong with these records.

Having carve up bank accounts for both business and personal transactions makes taxation fourth dimension easier. Non but will yous take clean, accurate records for the expenses you're writing off, merely personal transactions will exist kept private.

3. Keep accurate records

Speaking of clean data, taxation season will be much easier to navigate if you lot have authentic reports. Pull bank statements to reconcile income and outgoings with receipts or invoices. Or use an bookkeeping software that does it for you lot (more on this afterward).

Gratuitous samples are a common misrecorded expense, every bit Dan Luthi of Ignite Spot explains: "Sometimes people will just suit out and marker information technology off as inventory shrinkage when, in reality, it was actually a marketing expense.

Making sure it's reported correctly on your fiscal statements is crucial. Non that it gains you a massive corporeality of extra benefit, just information technology helps you to understand what your business comparability is, so when you're evaluating at the end of the twelvemonth in preparation for taxes, [people are] looking at the right information. You know what yous are actually utilizing for marketing spend versus just inventory adjustments.

Credit card points are oftentimes misrecorded, likewise. Scott Scharf, CTO of Acuity and co-founder of Catching Clouds, and Acuity company, says, "When you're buying $1 meg of inventory, that's a hell of a lot of points. And when modest business organization owners really accept a vacation, they can go and exist starting time form the whole way—everything covered all by points.

"Very few people track rewards points as profit to the business. The just time that would come up up would be in an inspect. It should be listed as income."

Free Download: vi Steps to Get Your Business concern Ready for Tax Season

Tax season is stressful for whatever concern possessor. This guide will go through the process of filing income taxes in America and provide y'all with checklists to keep you organized and prepared.

Get your complimentary guide

Almost there: delight enter your e-mail below to gain instant admission.

We'll likewise send you updates on new educational guides and success stories from the Shopify newsletter. Nosotros hate SPAM and promise to continue your e-mail address safe.

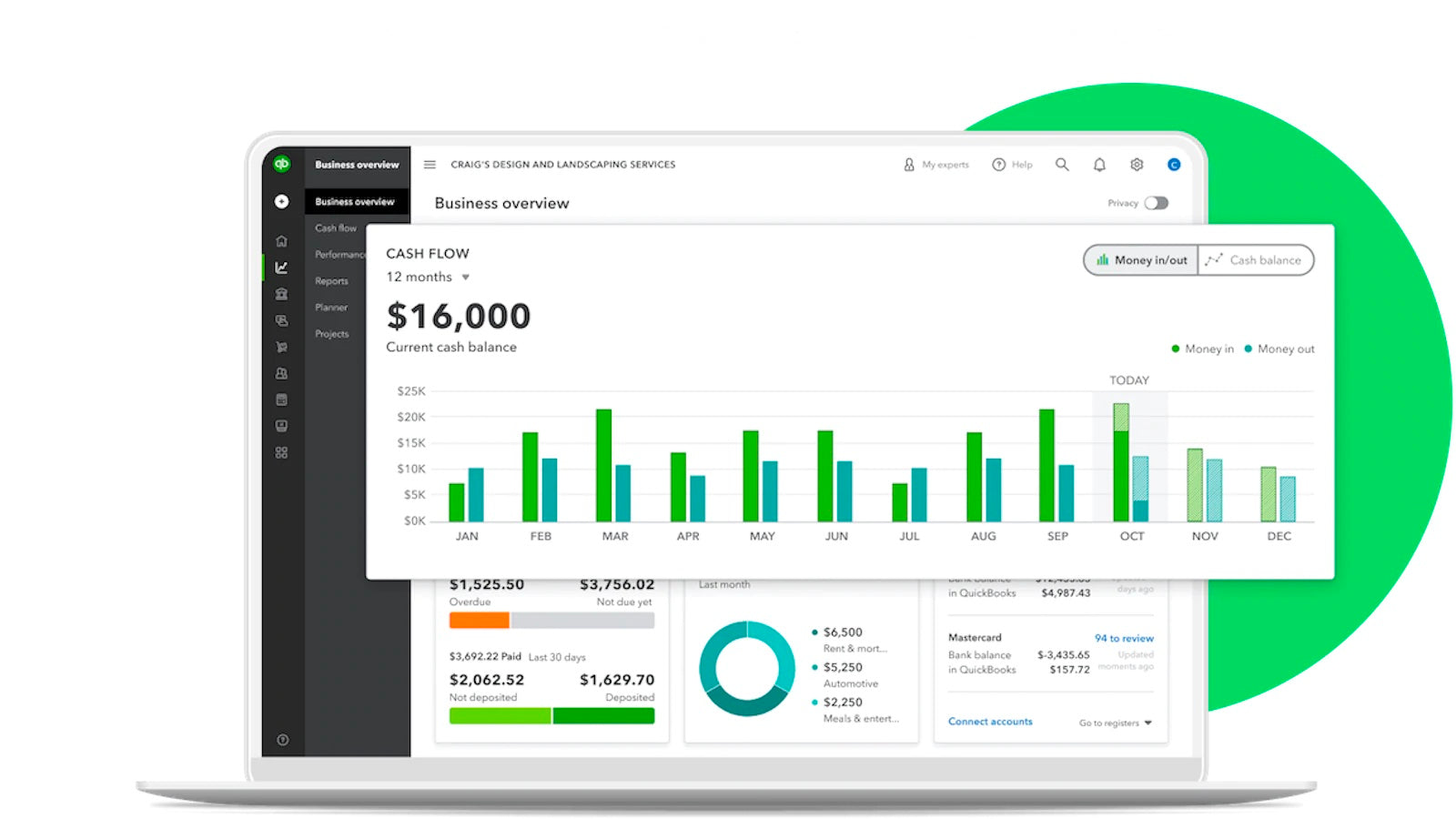

4. Use accounting software

Withal using a spreadsheet to manage your small business' taxes? The hazard of mistakes is much higher. Human mistake tin make tax returns inaccurate—a state of affairs you never desire to deal with.

Dan Luthi from Ignite Spot adds that "Excel is non going to provide yous with completely accurate information. It's not going to create financial statements for you lot. It's non going to tell you lot who your biggest vendors are or what yous bought from your biggest vendors this year."

You should never file your company tax return without consulting a competent tax professional or using a tax software program that can assist y'all in calculating deductions.

Accounting software exists to solve those problems. Platforms similar QuickBooks, Xero, and Sage integrate with your ecommerce store—saving fourth dimension, reducing errors, and automatically creating reports that'll aid y'all understand your business organization' finances.

From our ain data, nosotros saw an uptick in searches for 'cash menstruation' apps in the Xero App Store between February and July 2020 equally small businesses dealt with the effects of the global pandemic. We'd expect to see these apps remain popular, every bit they really aid minor businesses like retailers understand how their concern is doing, and what might be coming up in the future.

v. Pay estimated quarterly taxes

The IRS requires small business owners that predict to owe more than $1,000 at the end of the fiscal yr to make quarterly payments. Estimate your yr-cease tax bill and contribute to your twelvemonth-cease accounts by filing Form 1040-ES on these dates:

- Apr 15

- June 15

- September 15

- January 15

"This is important, since there is no tax withheld on business organization income flowing through to your private render," says Tim Yoder, Revenue enhancement and Bookkeeping Analyst at Fit Small Business organization. "Sole proprietorships reporting business concern income on Schedule C should make quarterly payments that include both cocky-employment tax and income revenue enhancement."

6. Set aside greenbacks for payroll taxes

As a small business owner who employs staff, you have a legal obligation to report, withhold, and pay employment taxes.

In that location are diverse types of tax to consider per employee:

- Social security tax: Employers pay half (6.2%) of employee earnings.

- Medicare revenue enhancement: Employers pay half (1.49%) of an employee earnings.

- Federal income tax: Varies depending on their salary and personal expenses.

Payroll apps like Gusto, ClockedIn, and Homebase can assist y'all when managing payroll and paying employment revenue enhancement. You'll see when payroll time is approaching, rail employees' working hours, and stay compliant with employment laws, all within ane dashboard.

People that utilise payroll solutions that are less involved—a lot of times they miss out on what their liabilities are with those and who they owe money to, whether that'south the IRS, the state, or their benefits organization.

"At periods of time, especially if they reported their taxes on an accrual basis, they should be able to actually deduct those expenses in the period that they were referenced, versus actually reporting them when they really paid them out 2 or three months after."

Related:3 Steps to Optimizing Cash Catamenia During a Crisis

vii. Track inventory accurately

Another metric you'll see on your small business' revenue enhancement render is inventory value—the dollar amount you have tied up in unsold inventory.

"Retailers must make up one's mind the cost of the trade they sell during the year," says Tim Yoder, Tax and Bookkeeping Analyst at Fit Small Business. "Doing this calculation past hand is very time consuming and decumbent to errors. Invest $50 to $lxxx per month for a quality bookkeeping package with inventory accounting, like QuickBooks, Zoho Books, or Xero."

Plus, if you're operating several retail stores, information technology helps to cull an inventory management system that acts as one source of truth for inventory-related information.

If you lot're not using one centralized place like Shopify to manage that inventory, or even the retail sales that are going along with it externally, information technology'south going to create more complications for you because you have to reconcile that data together.

Scott Scharf from Catching Clouds, an Acuity company says, "At minimum, yous should record the quantities in stock each month—exist that your ain garage, a warehouse, 3PL, at Amazon FBA— wherever.

"An accurate inventory count and an authentic value of that inventory—those two numbers and reasonable financials (even if they're a little messy), will become you fairly shut to what should be listed as total turn a profit or loss on your revenue enhancement render."

Related: Open-To-Buy Retail Planning: How to Plan Inventory Budgets Using the OTB Formula

eight. Know what'southward revenue enhancement deductible

The lower your profitability is, the less tax you'll be liable to pay at yr stop. One style to sensibly reduce profit is by claiming business-related items equally an expense.

According to the IRS, businesses tin write off whatever expense that meets this criteria:

- Ordinary: One that'due south commonly used by other businesses in your manufacture (i.east., other retail businesses).

- Necessary: Ane that's helpful or assists you in growing the business.

"A lot of times, minor business owners will say, 'I ate luncheon with this person, so that'southward a marketing expense,'" says Dan Luthi. "In a lot of cases, information technology'due south not. You accept to make certain that you're evaluating expenses correctly."

Allowable expenses for brick-and-mortar retailers include:

- Inventory

- Marketing

- Payroll

- Utilities (i.e., heating and lighting)

- Commercial lease

- Bookkeeping and legal services

- Insurance

- Shipping and delivery costs

- Retail packaging

- Home office deduction

- Equipment

The petrol yous used to drive fetch supplies? Mark that equally a business expense. The hotel you paid for while on a business trip? Mark that as a business organization expense. Anything that is a legitimate business deduction should be submitted to the visitor for a business report.

9. Contribute to your retirement account

Small business organization owners oft experience like their financial futurity is in their own easily. Set for information technology—and get a legal tax break—by contributing some of your business' profits to your own 401(one thousand).

The same concept applies to your store employees. Contributing to their retirement plan is an attractive perk for some retail store employees. Whatsoever contributions y'all do brand are tax deductible, making it a win-win for anybody involved.

10. Brand a charitable donation

Whether you're donating cash to a local not-turn a profit or supporting a cause in your customs, minor businesses tin can reduce their tax liability past making charitable contributions.

There are limits on how much money you can donate through the tax twelvemonth:

- Individuals can donate and write off up to 100% of taxable income.

- Corporations can donate and write off up to 25% of its taxable income.

This isn't only a tax-saving tip—it's a way to connect with your target customers. Our data shows consumers are four times more likely to purchase from a company with stiff brand values. Supporting local causes is a slap-up way to practice that.

xi. Use department 179

Purchased expensive equipment throughout the twelvemonth? Be that high-class lighting systems or store security cameras, use section 179 tax deduction to write off the full purchase toll and reduce your tax liability.

Again, there are strict rules effectually how section 179 tin can be claimed. Equipment must be used for business purposes more than than 50% of the time, actively used in the current fiscal twelvemonth, and purchased outright. There's also a $i.08 1000000 limit on the corporeality you can write off.

💡 PRO TIP: The toll of your Shopify POS plan, apps, and hardware y'all purchased for your retail shop qualify for Section 179 tax deductions.

12. Use bonus depreciation

Bonus depreciation is another manner to write off expensive equipment you've purchased for your store. Unlike department 179, the purchase price is deducted from business profits over the time information technology's used.

For instance: a high-form security organization cost the business $l,000. Instead of writing that off in your get-go fiscal year using section 179, bonus depreciation might see you writing off $5,000 for each yr it'south in utilize.

The master advantage of bonus depreciation is that there's no limit. Riley Adams, licensed CPA and founder of Young and the Invested, says "The depreciation can create a net loss, assuasive y'all to showtime future taxable income."

— Nick Huber (@sweatystartup) Jan 22, 2022Depreciation isnt a real expense that comes out of your checking account.

Information technology's a form of taxation deferment and is written off equally an expense on your taxes. It lowers your tax liability.

13. Use for the qualified business organisation income deduction

"Starting with tax twelvemonth 2018, a new law passed that allows a new 20% taxation deduction on your QBI [qualified concern income] that reduces your taxable income," Gail Rosen, CPA, PC, explains.

At that place are many provisions that change your eligibility for this deduction, including what type of service you offering, your income level, wages you pay and/or avails you ain. Brick-and-mortar retailers can exist eligible for this tax deduction.

To qualify for QBI deduction in 2022, a unmarried filer must take less than $170,050 in taxable income. This increases for articulation filers, such equally partners running a retail business, to $340,100.

xiv. Prepare for tax season in advance

Tax season is a stressful time for many store owners. But it doesn't accept to be. By getting your financial ducks in a row earlier tax time rolls effectually, you'll meet (or beat) deadlines—instead of scrambling around to reconcile a banking concern statement from six months ago.

Here are two important dates to keep on your small business' taxation calendar:

- March 15: S corporation and partnerships tax render

- April 15: Personal or single member LLC tax return

Sarah York, enrolled IRS agent and writer at Keeper Tax, advises, "The best time to recall about taxes is mid-November. The bulk of the year is over, and so you tin get a realistic forecast of your tax situation while there'south all the same time to program for it.

"This window of opportunity is where the most constructive strategic tax planning happens, and so be certain to marker it on your agenda now! In one case the year closes, even the best CPA won't be able to do much."

Small businesses should be meeting with their CPAs to do tax planning and adjust over time–preferably quarterly, merely at least in Q4. In October, November, and December, you should be meeting with your auditor and saying, 'Here are my rough numbers. What can I practice legally and properly to reduce my profitability?

15. Rent an accountant

"Small concern owners usually didn't go into business to be accountants," says Dan Luthi. "They got into business to make coin. They got into business concern to sell something that they love and that they're passionate about."

Free up time to focus on other parts of your business and offload your tax filing to a CPA—someone who can give you personalized revenue enhancement advice based on your business concern structure. C corporations, sole proprietors, partnerships, and limited liability companies all take different revenue enhancement preparation and filing requirements, and then it's hard to find one-size-fits-all advice online.

But with more than 1.44 million accounting, accounting, and auditing clerks to choose from, Scott Scharf besides recommends choosing a CPA with an agreement of inventory-based businesses.

"You want to brand sure that they understand cash versus accrual for an inventory-based business. And to await at things if they're using landed cost versus buy cost, which can have a huge affect on the profitability of the business," he says.

Not doing landed toll means yous're writing off all of your shipping as it comes in—even if it takes vi months to send all of your production—and that reduces your profitability.

Dan continues, "But if your CPA is on it, they might say, 'Await, what's the landed price? Why didn't you move this over to the balance sail?'"

Become your taxes right

Tax time is a stressful flavour for minor business owners who file, prepare, and pay their own taxes.

Use these tips to prepare yourself for the upcoming tax flavor. Whether you're checking if your concern tax deductions are allowed or consulting with a CPA on tax laws in your state, the best time to start planning is now.

Stay on top of your finances

With Shopify POS, it's piece of cake to create reports and review your finances including sales, returns, taxes, payments, and more. View your financial information for all sales channels from the same piece of cake-to-understand dorsum function.

Source: https://www.shopify.com/retail/small-business-tax-tips

Posted by: strobelexproning.blogspot.com

0 Response to "How To Make Money With Taxes For Having Your Own Business?"

Post a Comment